A Comprehensive Guide to Creating an Emergency Fund

This is especially the case where people are unable to save enough money to match current inflation rates. Nonetheless, an emergency fund ranks as one of the most important goals in personal finance. This financial reserve is for basic financial shocks, including medical bills, car issues, or a loss of job, which will keep you financially secure in the event of the financial shocks. An emergency fund is insurance; it gives the person a safety net so that in the case of an emergency the person can cope with it and does not have to borrow money or take any other reckless step.

In this ultimate guide, you are going to learn about why having an emergency fund is necessary, how much should be saved, where you should keep your money, and what you should do to build your emergency fund. you con also visit more The Beginner’s Guide to Investing

Reasons to Put Money Down for Emergencies

An emergency fund is the foundation of any financial planning. It is often said that life is unpredictable, and hence, no matter how well formulated a financial plan is, it is vulnerable to some form of distraction. Here are some reasons why having an emergency fund is essential:Here are some reasons why having an emergency fund is essential:

Financial Security

An emergency fund refers to a pool of money that helps one to meet with any imbalance or conservancy affecting his or her budget without necessarily encroaching on the set savings or borrowing.

Avoiding High-Interest Debt

If you didn’t keep a buffer amount as an emergency fund in advance, then you had to rely on credit cards or personal loans for unexpected occurrences. The availability of these choices has drawbacks such as massive interest rates, meaning high chances of internationalisation.

Peace of Mind

The knowledge that you now have money saved for a rainy day can help you prepare to meet life’s challenges without there always being stress and worry.

Job Loss Protection

In case you lose your job, then an emergency fund can enable you to meet your living expenses while you look for another job and also look for the kind of job you want.

How Much Money Should be Saved in Your Emergency Fund?

It is difficult to lay down a specific figure of how much one should save in the emergency fund as this depends on some factors such as the monthly expenditure, security of source of income and other circumstances. Here’s a general guideline to help you determine how much to save:Here’s a general guideline to help you determine how much to save:Three to Six Months of Living Expenses

Consider Your Job Stability

Factor in Dependents

Health and Insurance Coverage

Where could you place the emergency fund?

For an emergency fund to be effective, it has to easily accessible. Ideally the funds you are accumulating need to be readily available for emergent situations, yet they at the same time should not be as easily retrievable in the case that you require money for some trivial want. Here are some ideal places to keep your emergency fund:Here are some ideal places to keep your emergency fund:High-Yield Savings Account

Money Market Accoun

Short-Term Certificates of Deposit (CDs)

Should you wish to earn a slightly higher rate of interest on your money, then you could always put part of the emergency fund in a short term CD. However, do not forget that CDs have their maturity period and withdrawal of the funds will attract penalties.

Treasury Bills

For those who want a safe and locally regulated form of investment Treasury bills are securities that financial institutions and investors can buy which are backed by the government and mature within a few weeks to a year. Liquidity and security are provided as well as the investment return that may be lower than in other cases.

Avoid Investing in Stocks

Investing in stocks you stand a chance to get more returns but it is not recommendable when saving for an emergency fund. The value of stocks can even fall lower to zero, you do not want your emergency fund to be tied to stocks with the possibility of seeing its value reduce to zero.

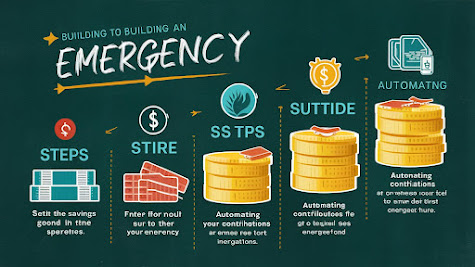

Ways on How to Establish Your Emergency Fund

Everyone wants to have an emergency fund because it helps them deal with situations that may affect their income; this is why creating it is not a one-day process but rather takes a lot of determination, time, and effort to create this strong foundation. Here’s a step-by-step guide to help you get started:Here’s a step-by-step guide to help you get started:

1. What is Your Financial Profile Right Now?

First of all, you should turn to the assessment of your current finances. Tabulate your monthly budget, going by the standard expenditures such as rent, utilities, food, transport, insurance among others and the other debts. This will enable you draw a better perspective of how much you are supposed to save.

2. It is important that the objective that is set for saving is achievable.

Analyze how much you spend every month and then come up with a viable target of how much you’ll be able to save. If your aim is to set aside at least half a year’s worth of living expenses, don’t approach the goal as a single, large lump sum. For instance, the initial target is to save an amount of money equal to expense for one month and then build up the rate from there.

3. Create a Budget

In this process, a proper built up budget is also significantly needed for establishing an emergency fund account. Specifically, you should establish those frugal fronts which you can trim from (or reduce) in order to funnel those savings to the emergency fund. One might want to incorporate the use of available budgeting applications or mobile applications in an endeavour to track the progress made.

4. Automate Your Savings

Having a cushion through what many call an ‘emergency fund,’ is as important as it is difficult; the best way to do it is to automate your savings. Pay yourself with the first funds that come into your checking account; transfer a specific amount to the savings account. This guarantees that one is continuously making deposits to the fund without having to rely on the spirit.

5. Prioritize Your Emergency Fund

Ensure that you make the emergency fund is a priority. It should be viewed as utility expenditure like rent or electric bill; something that one has to pay no matter the circumstance. Examples include situations where you get a windfall income like tax refund or bonus, this should be used at least in part to augment Emergency Fund.

6. Find Additional Income Sources

Cutting on expenses is not the only solution for those who fail to save some money, you better look for extra earnings. This may be a part time job, doing deals for employment for different companies, or selling items which are no longer useful to you. Any increment can then be taken and put into the emergency fund.

7. Cut Unnecessary Expenses

For your savings, analyse your consumption expenses on a monthly basis to be able to find ways and means to save. It could include consuming restaurant meals less, avoiding the subscriptions that you do not really use, or cutting on the expenses you do not require. Spend the money saved, in enhancing your emergency fund instead.

8. Use Windfalls Wisely

It is recommended to always set a part from your newly received income, for example, tax refund, bonus, or an inheritance, to add to the emergency fund. Now and then is a perfect opportunity to prepare a windfall which will help you to enhance your savings.

9. Reevaluate and Adjust Regularly

The reality is that eventually, people change and so do there requirements thus the need to note the following. To improve understanding of when your emergency fund is untenable, you should review your fund periodically to reflect on the current needs and objectives. If this proves to be true change the savings goal to fit the circumstances.

10. Avoid Temptations

After saving for an emergency, it is always easy to spend the money for other unnecessary expenditures What started off as an emergency fund may soon be spent paying for other things not related with emergencies. Always keep in mind that the emergency fund is strictly for emergencies that are genuine. pride and gain discipline and do not be tempted to use it for want like vacations, new gadgets among others.

Planning on How to Use the Emergency Fund

Car Repairs

An example is if you have a car that develops a mechanical fault and since you rely on it, it is prudent to use the emergency fund to repair it.

Home Repairs

Huge repair jobs like a damaged furnace, a leaking roof or a plumbing problem which are emergencies do warrant the use of your fund.

Family Emergencies: In the case of an illness of a family member or a death of a family member, your emergency fund will probably cover for a fare or something along those lines.

Rebuilding Your Emergency Fund

Once your emergency fund has been depleted, is very important to try to replace your lost cash as soon as possible. Here’s how:

Resume Automatic Transfers

After you have used your emergency fund, set your automatic transfer back to the requisite saving norm to begin rebuilding it.

Adjust Your Budget

Go back to the budget and look over the expenses wherein you can spend less for a while just to fund the replenishment of the said fund.

Use Windfalls

Whatever additional money is received in the form of incentives, bonuses, tax returns; the extra should be saved in an emergency fund.

Stay Disciplined

Go on to maintain the desired level of emergency fund, which should be kept optimal until replenished to the ideal amount.

Conclusion

Saving for the rainy day is one of the most important things that one needs to do to prepare financially for the future. States that, adhering to the instructions of this guide, it is possible to develop a truly reliable emergency fund that will help keep you calm and safe in unpredictable life situations. Make small deposits regularly, be disciplined, and then prove up this emergency fund over the years.